🌍 Non-Resident Property Management with Shelterly.

Seamless Management for Non-Resident Owners

At Shelterly, we simplify the complexity of owning rental property in Canada as a non-resident. From monthly CRA remittances to year-end tax filings, our tailored process ensures compliance, maximizes refunds, and gives you peace of mind—no matter where you live.

Our Services for Non-Residents

-

CRA Compliance Management

We manage monthly CRA withholding by calculating the required 25% on gross or net rental income, remitting payments by deadline, and maintaining compliance records, so you avoid penalties and enjoy seamless property ownership abroad.

-

NR6 Filing

We prepare and submit NR6 elections so landlords remit tax on net rental income instead of gross, improving monthly cash flow. Shelterly coordinates calculations and submissions to ensure accuracy, timely approval, and reduced withholding amounts.

-

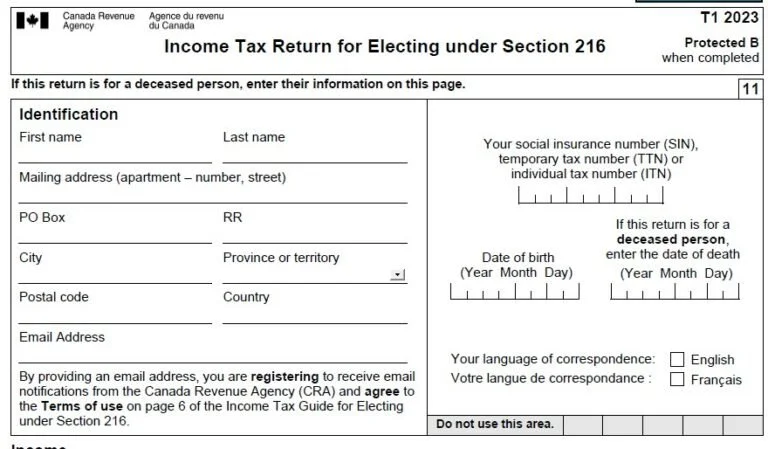

Section 216 Tax Returns

Our accounting partner files Section 216 tax returns annually to reconcile income and expenses. We recover overpayments, maximize refunds, and ensure full compliance with CRA, giving landlords clarity, savings, and peace of mind.

-

ITN Applications

Non-residents without a Canadian tax number are supported with ITN applications. Shelterly gathers required documents, manages communication with CRA, and ensures timely issuance so rental income reporting and compliance obligations remain seamless.

-

Sale of Property Compliance

When selling, Shelterly manages CRA’s Certificate of Compliance. We handle T2062 filings, coordinate with purchaser’s lawyer, calculate withholding on net capital gains, and ensure funds are properly released, avoiding costly penalties and delays.

-

Financial Reporting

We provide monthly financial reporting that includes reconciliations, GST/HST summaries, income statements, and balance sheets. Landlords receive accurate, transparent records that keep them fully informed, confident in compliance, and financially organized year-round.

Get Ready for Take Off.

Download our free Non-Resident Brochure

How We Make a Difference

Seamless Management

We provide seamless management by combining property oversight and CRA compliance under one roof. Our professional team coordinates every detail, ensuring landlords experience smooth operations, accurate reporting, and reliable results without the stress of juggling multiple providers or responsibilities.

Maximum Refunds

Our accounting expertise ensures landlords never leave money on the table. By carefully reconciling expenses, filing NR6 elections, and preparing Section 216 returns, we recover overpayments and maximize refunds, delivering measurable financial benefits through a seamless, professional, team-managed process.

Peace of Mind

With Shelterly, landlords enjoy complete peace of mind. You never deal with CRA directly—we manage compliance, communication, and deadlines end-to-end. Our experienced team ensures accuracy, timeliness, and protection, so property ownership abroad feels effortless and entirely worry-free.

Pricing

$37

Monthly CRA Compliance Handling

For an additional $37 per month (added to the standard management fee), Shelterly manages monthly CRA remittances, calculations, and confirmations. This affordable fee provides professional oversight, timely payments, and peace of mind, ensuring non-resident landlords remain compliant without stress.

$495

Annual Tax Return (Section 216)

We charge a clear, flat fee of $495 for preparing and filing the annual Section 216 tax return. This ensures all income and expenses are reconciled, refunds are maximized, and compliance is maintained seamlessly by our professional accounting partners.

from $60

Additional Services

Custom pricing applies for specialized services such as ITN applications, NR6 elections, or CRA compliance during property sales. Each case is unique, so our team provides a transparent, upfront quote, ensuring landlords know exact costs before proceeding with professional support.

The Process

-

Schedule a free consultation with Shelterly to review your non-resident obligations and rental property goals. Our experts explain the process clearly, answer questions, and outline the steps to ensure your property remains fully compliant and stress-free.

-

Once you’re ready, we begin onboarding immediately. Shelterly collects your documents, sets up CRA compliance, files necessary elections, and establishes your reporting dashboard. Our team ensures everything is seamless, professional, and prepared for ongoing monthly and annual compliance.

-

Shelterly provides complete ongoing care, including monthly CRA remittances, reconciled financial reports, and year-end Section 216 filings. Our experienced team handles every detail with precision, giving you peace of mind and confidence your investment is in good hands.

Tell us about future abroad ✈️

info@shelterly.ca

10 Four Seasons Pl. #1000

Toronto, ON, M9B 0A6